Is Real Estate a Good Investment?

Investing in real estate has always been considered an excellent way to accumulate wealth and gain stability in finances for centuries. It offers multiple benefits and comes with a various opportunities, yet it also requires careful thinking and planning. So is it good to invest in real estate?

Is it good to invest in real estate?

Certainly, real estate investment has unique advantages that entice both first-time and seasoned investors. Real estate property is a tangible asset that appreciates over a period of time offering reliable returns through rental income and tax benefits. It also comes with other benefits like deductions on mortgage interest and property taxes. First-time homebuyers, in particular, can avail of favorable loan options and down payment assistance, making homeownership a dream come true. While real estate requires a time commitment and market research, its potential for wealth accumulation and stable returns makes it completely worth the effort providing an affirmative answer to the question - is real estate a good investment..

Why is Real Estate Considered as a Good Investment?

Real estate investment comes with unique benefits that are different from other types of investment options:

Tangible Asset with Appreciating Value

Real estate is one tangible asset that appreciates in value over time. Stocks and bonds are pieces of that could depreciate overnight. A real estate property often is likely to increase in value based on the improvement of structures, the development of the locality and various infrastructural facilities around. Traditionally, the value of land has considerably increased over the recent few years, especially in areas that are considered to be developed and have good infrastructure for schools and employment. This answers the question of whether is it good to invest in real estate and would it be possible to generate cash flow as compared to other types of investment opportunities that are available.

Reliable Market Outcomes

It generates a reliable rental stream for paying off a mortgage, real estate tax, and maintenance cost, among other benefits from equity, provided of course, with timely interest coverage.

Tax benefits

Mortgage interest, property taxes, and other expenses related to the management of rental properties are exempted from tax. Similarly tax exemption can be obtained through depreciation. Specific tax credits and deductions are also available for first-time home buyers, making homeownership more accessible and financially beneficial.

Opportunities for Leveraging

Leverage means one can make some down payment and finance the rest, so the potential returns could be much larger than other assets. For example, if a person purchases a property of Rs. 3,00,000,by investing Rs. 60,000, the return is based on the full value of that property and not just Rs. 60,000.

Also Read: What is Carpet Area and How We Can Calculate It

Advantages to First Time Home Buyer

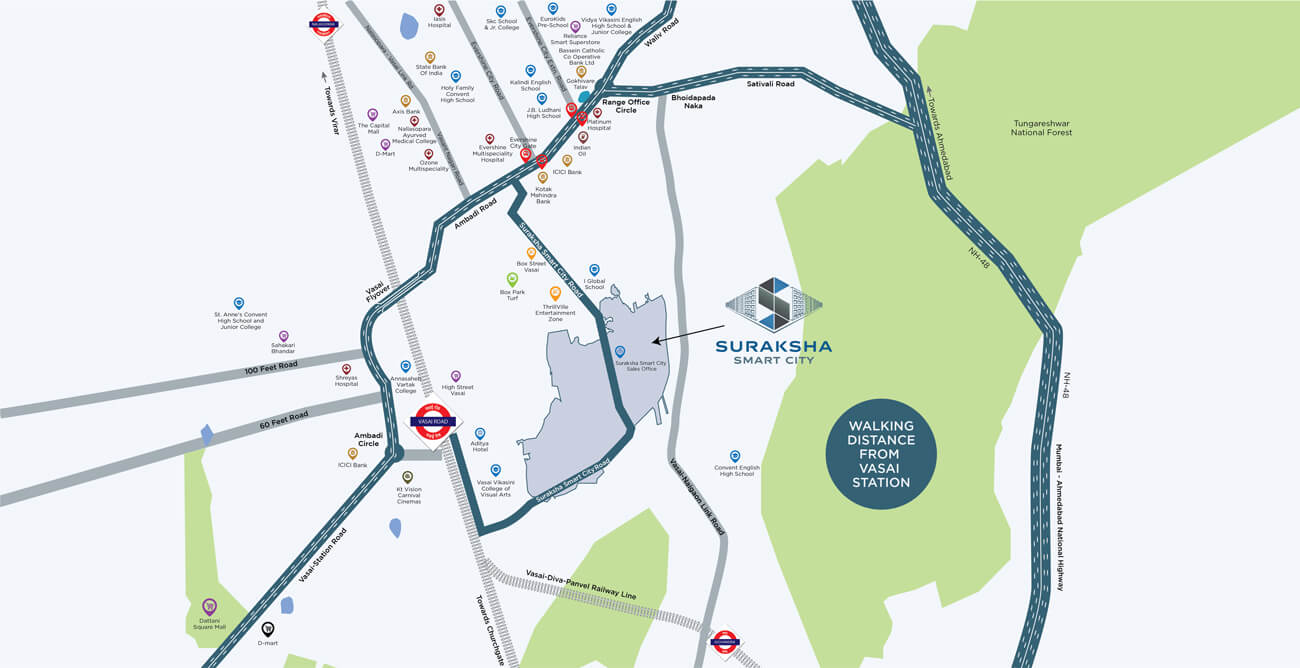

First time buyers can avail of benefits like down payment options, mortgage rates that are low in comparison to the past, and various assistance programs designed to help buyers afford a first home thus providing an answer to is real estate a good investment. These benefits make home ownership in gated communities like property in Vasai East, Suraksha Smart City more achievable and desirable as an investment in real estate for decades to come.

Real Estate Investment Trusts (REITs)

REITs enable investors to invest in real estate without directly owning any physical properties. This allows one to experience the diversity of real estate investments by investing in a REIT through shares and collecting dividend income based on the revenue received.

Points to Ponder Before Investment

Market Conditions

Market conditions are different from one area to the other and vary with changing economic conditions. It will be necessary to study the trends in the local areas and property prices, opportunities to get tenants easily, and the rate of property appreciation.

Financing Options

It is important to know the financing options. Many first-time homebuyers rely on financing for buying a home. Thus, it is important to be aware of the available financing options, types of mortgage options, interest rates, and government programs for helping first-time homebuyers.

Time commitment

Managing real estate investments requires a great deal of time, particularly with rental properties. Even though there can be short-term fluctuations of properties, a long- run outlook is necessary for successful implementation. Prepare for ups and downs in the market and have your plans ready for the future.

Here, we see whether is it good to invest in real estate and the returns that can help an investor acquire wealth over time. For those seeking a high-appreciation, passive-income- generating investment that could save tax, one can find the answer to is real estate a good investment that can be entered into generate desired cash flows. First-time home buyer perks and first-time home buyer advantages are usually beneficial in easing the financial burden, and paving the way for owning a home. However, research and the appropriate planning are important and a gateway through the complexities of the real estate market. Based on that, you can proceed in making an informed decision, thereby determining whether real estate is the investment you actually require.

Also Read: Vasai - The Hidden Gem of Real Estate Market

Frequently Asked Questions

How can one fund the first real estate investment?

You can get your first real estate by financing the purchase with traditional mortgage loans, government-backed mortgages, or alternative funding sources. It's very essential to compare all types of funding to ascertain that which suits a particular financial condition best.

Are there advantages specifically for first time homebuyers?

Yes, as it is, first time homebuyers are taking advantage of the many different forms of advantages. The major ones are the options with lower down payments, tax credits, and programs aimed at making homeownership accessible to everyone. Such advantages reduce the total cost of owning a house and create a strong base for other investments.

Monday | November 18, 2024